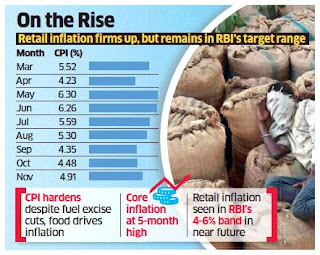

India’s retail inflation firmed up to a three-month high of 4.91% in November from 4.48% in the month before as higher food inflation negated the drop in fuel inflation following the reduction in excise duty.

This is the second straight month retail inflation has hardened but remains within the Reserve Bank of India target range of 2-6%. Economists expect the Reserve Bank of India to continue to maintain policy rates to support growth.

Urban inflation accelerated to 5.54% in November from 5.04% in the month before. Increase in the rural inflation was muted at 4.29% from 4.07% over this period.

Food inflation accelerated 1.87% last month from 0.85% in October. Fuel and light inflation eased from 14.35% in October to 13.35% in November after the centre cut diesel prices by Rs 10 per litre and petrol by Rs 5 a litre in the first week of November. Many states had followed up with a reduction in the value-added tax on fuels. Consumer Price Index inflation was 6.93% in November last year while food inflation was 9.5%.

“Excise relief on petrol and diesel and cut in VAT by most state governments have not provided much relief to retail inflation… Supply shortages are further aiding to higher inflation, which cannot be termed as transitory,” said Devendra Kumar Pant, Chief Economist, India Ratings and Research.

Core inflation (excluding food and fuel), a measure of demand, rose to a five-month high of around 6% in November.

The Reserve Bank of India (RBI) had kept the key interest rate unchanged in its monetary policy review earlier this month. It expects FY22 consumer inflation at 5.3% and projects 5% retail inflation for the first quarter of FY23.

India Ratings said that retail inflation is likely to remain in the 4-6% range most of the time in the near future.

“In our assessment, as long as the CPI inflation remains within the target of 2-6%, the MPC and RBI will prefer to prioritize growth, and maintain policy support to impart durability and sustainability to the recovery,” said Aditi Nayar, chief economist ICRA. “As of now, there isn't enough evidence on the durability of the growth recovery to confirm that the stance will be changed to neutral in the February 2022 policy review.”

No comments:

Post a Comment