I have tried to follow the India story for the last 14 years.....the best is yet to come. This effort comes to an end as India is 75! Thanks for reading......Jai Hind!

15.8.22

That's All Folks !

I have tried to follow the India story for the last 14 years.....the best is yet to come. This effort comes to an end as India is 75! Thanks for reading......Jai Hind!

Centre prepares blueprint in major push for high-speed transport infra

As the government puts focus on developing high speed transportation networks for passengers and goods, the railway ministry is considering the laying of greenfield railway lines along existing tracks between Secunderabad and Bengaluru for running semi-high speed trains at 200 kmph. Meanwhile, the road transport and highways ministry has also prepared the blueprint to increase the length of expressways and access-controlled highways to 20,000 km in the next two decades.

Sources said the initial estimated cost of the semi-high speed track connecting the two IT cities in Telangana and Karnataka is around Rs 30,000 crore and this project may be taken up under the Gati-Shakti initiative. They added since the new tracks would have to be segregated from the existing tracks for faster train movement, the railways would need to build side walls of 1.5 meter along the new tracks.

Railway ministry officials said the rollout of more Vande Bharat-type trains, which can run at a maximum speed of 160-200 kmph will get priority in the next two-three decades as the national transporter steps up efforts to increase the speed of trains by augmenting track infrastructure. “Going for Vande Bharat coaches is the natural progression and this is going to happen soon. Decades after the introduction of conventional passenger coaches or ICF, we went for modern and safer coaches or LHB. The next step is to go for Vande Bharat train-sets. These will eventually have a major share of our passenger rolling stock,” said a railway ministry official.

Officials said the roadmap for the road and rail infrastructure for the next 25 years will be on reducing the logistics cost and integrating the transport network, known as multi-modal transport system.

The highways ministry has prepared the blueprint to increase the length of expressways and access-controlled highways by more than 15 times in the next two decades in its bid to provide seamless networks for faster movement of freight. These high speed highway networks will connect the 770 economic nodes which have been identified. “The future planning and implementation of the infrastructure projects will be complete integration of airports with railways, Metro Rail and highway network. The transit has to be seamless. Another thrust area will be reduction of construction cost and time,” said a senior government official.

Similarly, in the case of city transport, the focus will be on developing a mechanism where the state transport department or a transport corporation would have an online platform to allow people to buy tickets that can be used for different modes of transport.

A senior official in the road transport ministry also said all the future and existing major national highway stretches will get charging stations for electric vehicles. “It’s a foregone conclusion that in future we will have more electric vehicles and the ones running on other green fuels. The planning has to start now so that we are ready to meet the emerging requirements,” he added.

PMR: 32km of ring road work set to start after this monsoon

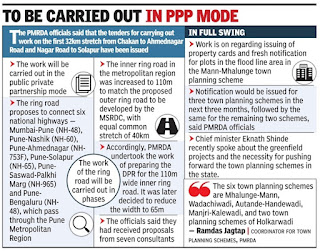

The Pune Metropolitan Region Development Authority will commence work on the 32km stretch of the ring road from Chakan to Nagar Road after the monsoon, PMRDA officials said. The work of the ring road will be carried out in phases. The ring road proposes to connect six national highways — Mumbai-Pune (NH-48), Pune-Nashik (NH-60), Pune-Ahmednagar (NH-753F), Pune-Solapur (NH-65), Pune-Saswad-Palkhi Marg (NH-965) and Pune-Bengaluru (NH-48), which pass through the Pune Metropolitan Region.

The Pune district authorities had proposed two ring roads to enable commuters to reach the national highways faster. A round 173km ring road is being implemented by the Maharashtra State Road Development Corporation and the other by the PMRDA. The previous Maha Vikas Aghadi government had decided to prioritise the MSRDC ring road.

The PMRDA officials said that the tenders for carrying out work on the first 32km stretch from Chakan to Ahmednagar Road and Nagar Road to Solapur have been issued and will be carried out in the Public Private Partnership mode. The revised detailed project report stated that the width of the ring road has been reduced from 110m to 65m. The officials said they had received proposals from seven consultants.

The inner ring road in the metropolitan region was increased to 110m to match the proposed outer ring road to be developed by the MSRDC, with equal common stretch of 40km. Accordingly, PMRDA undertook the work of preparing the DPR for the 110m wide inner ring road.

However, it was later decided to reduce the width to 65m for which a new agency will be appointed. The 40km common stretch has been handed over to the MSRDC for development, while the work on the 6.19km stretch from Wagholi to Lohegaon has already been undertaken. Thus, the new DPR will only be for the remaining 81.89km and the agency is expected to prepare a detailed plan based on the need of citizens. Last year, the state government had decided to reduce the width of the ring road of the PMRDA to 65m.

The decision taken by the state government will boost the work on the ring road, which has been stalled for the last few years, said officials

Big Bull Rakesh Jhunjhunwala dies

Rakesh Jhunjhunwala believed deeply in India. He was always willing to talk passionately about how its economy and financial markets would soon join the ranks of global superpowers. He put his money where his mouth was — investing billions on the basis of his unflagging belief in the country. On the eve of its 76th Independence Day, India lost one of its biggest supporters. Jhunjhunwala, billionaire investor, stock trader, qualified chartered accountant and philanthropist, who recently became the co-owner of India’s newest airline, passed away after fighting several health-related issues for the last few years. He was 62. His family found him unconscious early Sunday morning and rushed him to Breach Candy hospital where he was pronounced dead

Only Indian tech will power BSNL’s 4G, 5G upgrade

The government has decided to restrict foreign telecom vendors from the mega 4G and 5G modernisation projects at BSNL and MTNL – which have been handed out a Rs 1.64 lakh crore revival package – and instructions have been given to award contracts primarily to Indian companies.

The ambitious localisation move – being initiated for the first time ever – is being undertaken with an eye to develop core technologies and equipment within the country without much dependence on international players.

The government also wants that intellectual property rights related to the new technologies should stay within India, especially at a time when concerns around cyber security and data espionage are growing across the world.

The localisation move has also been pushed at the highest levels within the government, with Union communications minister Ashwini Vaishnaw asking the top management at BSNL and MTNL to follow the diktat, or risk facing action. “It’s clear that BSNL will only and only use technology that is Made in India. That’s absolutely clear. Just forget all the loyalties you had in the past, and move ahead. If you want to maintain the past loyalties, go back with them (foreign vendors). I am being very blunt,” Vaishnaw told top officials of BSNL and MTNL.

The minister emphasised that “only and only the technology which is ‘Made in India’ has to be used” in all network upgrades to 4G and 5G. “We are infusing so much money (through the revival package) because BSNL is a strategic company in a strategic sector. In a strategic PSU, we will use only trusted inputs and technologies which are ‘Made in India’ under the Atmanirbhar Bharat programme. You should forget the rest, and take it out of your mind that there is any other technology or any other company. ”

BSNL and MTNL have previously deployed equipment provided by Chinese and European suppliers, though now local companies such as Shyam VNL, HFCL, and TCS-Tejas combine are providing new products and indigenously-developed equipment.

Vaishnaw also said that while the Indian technologies may not be superior in the beginning, they are expected to get better with time. “May be there are some teething problems which need improvement. How many of you here are engineers? I guess the majority. Is there anything perfect in the beginning? There are improvements, versions, new features etc… that’s the way of life, that’s the way we studied, that’s the way we trained, that’s the way we have practiced in the field. ”

Local companies are confident of the government’s indigenisation push. “We have field-proven, secure and sustainable 4G/LTE communication solutions… With the introduction of 5G, we are hopeful that our innovations will also help in bridging standardisation gaps,” Rajiv Mehrotra, chairman of VNL, said.

Mahendra Nahata, MD of HFCL, also sees BSNL’s 5G push as an enabler for local technologies and homegrown companies. “We are excited about the 5G rollout becoming a reality soon and the vast opportunity that will unfold for Indian enterprises and consumers… 5G will allow enterprises to embark on the Industry 4.0 journey, and it will help accelerate digital transformation across industries,” Nahata said, adding that he sees tremendous opportunities for the company’s telecom equipment and optical fibre cables businesses.

The consortium of TCS-Tejas as well as the government’s C-DoT will most likely take up a major portion of BSNL’s 4G, and 5G, deployment. “C-DoT’s core will be used for the network, while Tejas will make the equipment and TCS will carry out system integration,” an official said.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)