Reserve Bank of India Governor Raghuram Rajan left interest rates unchanged as expected while signalling a possible easing if conditions were favourable, but surprised investors by lowering the portion of deposits that banks should hold in the form of government of government bonds, taking yet another step in long term reform of the sector. Currency market rules, tightened last year, are being eased.

Foreign and local investors are permitted to trade in exchange rate derivatives, and the limit of individual overseas remittances has been raised. Rajan declared that he's done with raising interest rates since any price spike in farm products would now be seasonal, and is ready to lower them if there are signs of the accelerated easing of price pressures.

This will come as welcome news for finance minister Arun Jaitley as the Narendra Modi government has made reviving the economy one of its primary aims.

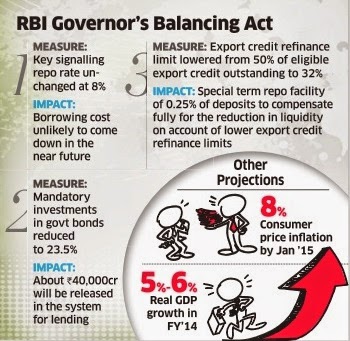

The governor left the repo rate, at which the central bank lends to banks, at 8%. Other active interest rates such as the reverse repo and the marginal standing facility rates were also unchanged. But the SLR, the proportion of deposits that should be held in government bonds, was cut to 22.5%, from 23%. Finance minister Jaitley said RBI had followed a calibrated approach.

The government is also concerned with restarting the investment cycle and moving towards higher growth and employment generation. We would like to address the problem of inflation through supply side measures particularly in relation to food inflation.Fiscal consolidation is a priority for the government,“ Jaitley said.

Actions taken in the policy review are unlikely to lead to any immediate relief for individuals with home loans or companies with project loans, but they prepare the ground for funding an economic recovery that many say is round the corner. Economic growth projection at 5-6% for the fiscal year has been retained, with the possibility of achieving 5.5%, suggesting a revival is imminent after two years of below-5% growth.

Governor Rajan has raised interest rates thrice since taking charge in September last year to fight inflation amid criticism that food prices could not be contained through such action. But he persisted as he believed that real interest rates, adjusted for inflation, have to be positive for the economy to get back to the path of sustainable growth.

In fact, the Chicago School economist has committed himself to the target of 8% consumer price inflation by the end of the year and 6% by next year as recommended by the Urjit Patel committee.

Inflation, which was easing, has been rising again due to food shortages. A below-normal monsoon, given the 70% possibility of El Nino developing by August, could play spoilsport. But the central bank is now suggesting any price rise would be temporary and even if prices do increase, this need not lead to an elevation in interest rates. Inflation based on the consumer price index (CPI) accelerated to 8.31% in March and then 8.59% in April, reversing the few months of easing before that.

Rajan's optimism has led to the belief that this probably is a dovish policy that could turn more growth-oriented if the macro-economic numbers fall into place.

The governor initiated more longer-term reforms of the banking sector by reducing export credit refinance to 32% from 50%, which could create a level-playing field between suppliers in the domestic market and exporters. This was among the recommendations of the Patel committee.

But to reduce the impact on the cost of funding, RBI also introduced a special term repo window to the extent of 25 basis points of total deposits that banks can borrow from. A basis point is 0.01 percentage point.

No comments:

Post a Comment