India’s services sector activity retreated in July from an 11-year high in the previous month but remained firmly in the expansion zone, a private survey showed.

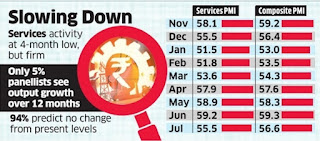

The S&P Global India Services PMI Business Activity Index slipped to a four-month low of 55.5 in July from 59.2 in June.

A reading of over 50 on this survey based index shows expansion.

New work intakes rose but weaker sales growth amid inflationary pressures and unfavourable weather dampened demand in July, pulling down the index. “In line with concerns that economic growth has weakened as we enter the second fiscal quarter, service providers signalled subdued confidence towards the medium-term business outlook,” said Pollyanna De Lima, economics associate director at S&P Global Market Intelligence.

Only 5% of those surveyed forecast output growth over the coming 12 months, while 94% predict no change from present levels.

Both output and sales increased at the weakest rates for four months and there was a negligible increase in service sector employment across India. Despite the moderation, business activity remained firm. “Business activity continued to rise strongly, with a similarly robust uplift in new business as the offering of new services and marketing efforts bore fruit,” De Lima said.

The domestic market remained the key source of sales growth as international demand for Indian services worsened further.

Rahul Bajoria, chief India economist at Barclays, said that some moderation in July services PMI paints a picture of relative economic resilience, despite rising global headwinds.

A sister survey on Monday showed that manufacturing PMI rose to 56.4 in July from 53.9 in June on the back of a significant rise in business orders.

The S&P Global India Composite PMI Output Index, which measures services and manufacturing activity, fell to 56.6 in July from 58.2, highlighting the slowest increase since March.

Bajoria said though global headwinds are rising, domestic demand is likely to provide stability to growth.

No comments:

Post a Comment