Finance minister Nirmala Sitharaman urged tax officials to ensure transparency and remove any scope for discretion and said introduction of the Goods and Services Tax has ushered in compliance and helped remove the cascading and overlap of various taxes.

Addressing a gathering on GST Day, the FM also complimented the officers for their hard work, which had ensured compliance and helped raise much-needed revenue, while plugging gaps. July 1 has been set as the GST Day because the most ambitious tax reform measure was rolled out on this day five years ago.

“Not even last year I would have had the motivational aura in the audience if we were to meet. Thanks to the hard work that each of you have done over the last five years,” said Sitharaman, adding that the tax reform measure had faced several challenges in the past five years. She cited the technology and adaptability challenges of 2019 and recalled the Centre’s efforts to get the tax paying committee to sit with officers handling GST to ensure that the challenges were resolved.

The FM said the two arms — the Central Board of Indirect Taxes and Custom (CBIC) and the Central Board of Direct Taxes (CBDT) — should be nimble in their efforts to ensure confidence for the taxpayers so that they feel that their inputs are being respected. The FM said the CBIC had responded to suggestions from the industry and the tax arbitrage, that existed between states before the GST rollout, was removed.

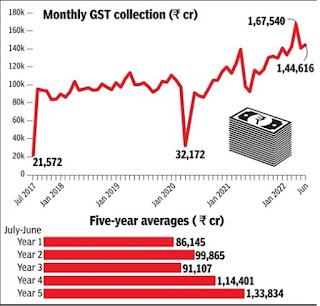

She said concerted action against evaders and a strong economic recovery had ensured that GST receipts remained robust. “Coupled with economic recovery, anti-evasion activities, especially action against fake billers have been contributing to the enhanced GST. ”

No comments:

Post a Comment